Investment Group – Meeting 3 -Aug 1, 2023

“AirBnB/Short-Term Rentals”

Investment Group – Meeting 2

“Intro to Analyzing an Investment”

Resources

TONS of resources on Youtube, Instagram, Podcasts, Books, Seminars, Mentoring Programs,, etc!

Internal Rate of Return (IRR)

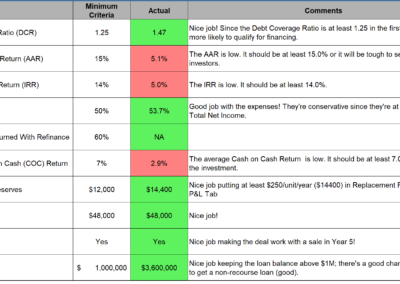

IRR is the rate of return each dollar in an investment earns while it is in the investment. IRR is another term for interest rate, discount rate, or yield. The IRR gives investors the means to compare alternative investments based on their yield.

IRR isolates the return on portion of the total amount of money received from the investment over the holding period. To have a return on investment, dollars received must exceed dollars put into the investment. This return on rate depends on both the amount of the excess and when the excess is received.

Net Operating Income

NOI is the annual income generated by an income-producing property after collecting all income from operations, such as rentals and other uses of the property by others, and deducting all expenses required to operate the property. The assumptions and judgments made in calculating NOI greatly affect the decision to invest in a given property and at what price. Lenders use NOI to determine loan amount, investors to determine what they will pay, and appraisers to determine market value.

The four basic components of NOI are:

▪ Potential rental income (PRI)

▪ Vacancy and credit losses

▪ Other income

▪ Operating expenses

NOI is calculated using the following model:

Net Operating Income

Potential Rental Income

− Vacancy and credit losses

= Effective Rental Income

+ Other Income (collectible)

= Gross Operating Income

− Operating Expenses

= Net Operating Income

Cash on Cash

Annual cash flow / Total cash invested = Cash on Cash Return

10,000 /100,000 = 10%

60,000/1,000,000 = 6%

Debt Service Coverage Ratio (DSCR)

NOI / Debt Service = DSCR

100,000 / 80,000 = 1.25

Assuming annual NOI of $100,000 and an annual total Debt Service of $80,000 ($6,666.67 per month loan payment)

Loan to Value (LTV) and Loan to Cost (LTC)

Loan amount / Value of asset = LTV

800,000 loan / 1,000,000 appraised value = 80% LTV

Loan amount / Total cost of asset + renovations, soft costs, etc = LTC

800,000 loan / 1,250,000 = 64% LTC

Average Annual Return (AAR)

( Total Profits / Total Invested ) / Years investment was held = AAR

(90,000/75,000) / 5 = 24%

1% Rule of Thumb

Quick and only preliminary analysis. If result of following equation is 1% or more then it may be worth investigating further:

Monthly rental income / Total cost of investment = %

1,500 / 150,000 = 1%

Careful with “rules of thumb” as they are not to be solely relied upon and if they are may casue you to miss out on a deal or to pursue a deal that isn’t a good one!

Investment Group – Meeting 1